Your passport to

stress-free global payments

Simplify cross-border payments: Say goodbye to wire fees, complex currency conversions, and manual reconciliations. With PayFromAway, making and receiving cross-border payments is as easy as it gets.

Book a demo

Want to see our platform in action? Submit a request and one of our account representatives will be in touch soon.

Contact Us

Leveraging PayFromAway

When you partner with PayFromAway, your international community members can easily pay your fees without stress, hidden costs, or unnecessary risk. You’ll be set up with a custom admin dashboard where you can enjoy reduced lifting fees, simplified reconciliation, enhanced security, and a full team of experts to support you and your community members.

The Future Of Global Payments

If you’re not using PayFromAway, you’re wasting time and money on international payments. Here’s how our simple and secure platform will make your life easier while elevating the experience you provide your community members.

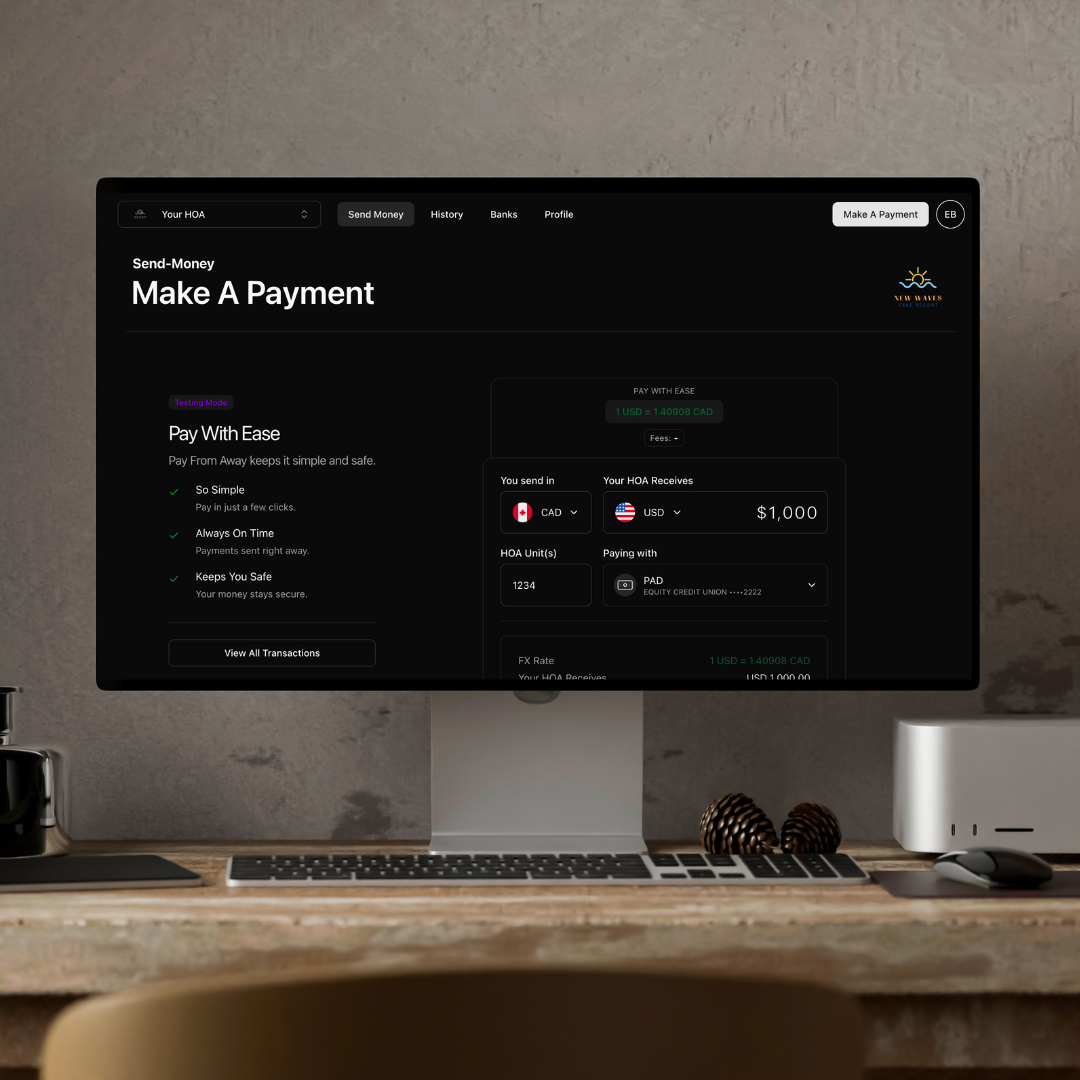

Your Dashboard

- Easily export your transaction data into a user-friendly spreadsheet for reconciliation in third-party accounting systems.

- Export and print your reports in just a couple of clicks.

- Receive drill down reporting for every transaction.

- Easily navigate your users and specific transactions with our simple search filters.

- View and search through all of your historical transaction data.

Your Community Experience

Your community members will enjoy:

- Secure platform accessible via computer, tablet or smartphone

- Cost transparency every step of the way

- Competitive currency exchange rates

- Automatic payments to avoid overdue accounts and late payment charges

- Enhanced security

- Expert support from the PayFromAway team

Multiple Payment Options

PayFromAway empowers you and your community members with multiple payment options, including ACH, PAD, and Credit Card payments. On top of that, recurring auto payments are available to optimize accounts receivable and offer a hands-off approach to monthly payments.

Data and Security

Your security is our top priority. PayFromAway offers enhanced security and data protection in a number of ways.

- PayFromAway stores your transactional data and keeps your records secure.

- Multi-factor authentication is used to verify residents' identities and protect their information.

- Association banking details remain private with PayFromAway as your intermediary.

PayFromAway For Your Industry

If you accept payments across multiple currencies, get in touch to learn about how PayFromAway can support your needs.

Home Owners Associations

Residents can pay their HOA bills & associated fees all on one user-friendly platform.

Golf and Members' Clubs

Collect member fees and dues on your simple and secure platform & avoid administrative headaches.

Adventure Providers

PayFromAway helps you accept your guests' payments without missing a beat.

FAQ

The PayFromAway Blog

Latest updates from PayFromAway & the broader industry